I was wrong about the PC. As a kid I played with the TRS-80, Apple ][ and C64 – I was engrossed in them all, I thought they were the future. But I didn’t predict the sweeping change the PC would have on society and the economy. I didn’t devote my hobbies and education to learning more about computer science.

I was wrong about the Internet. I was introduced to UNIX as an intern at Bell Labs, I read BBSes, I was on CompuServe and Prodigy and AOL, I used Mosaic. I enjoyed them all, I understood how these were the future. But I didn’t anticipate how all-encompassing this future could become. I didn’t devote my early career plans to working in Internet companies.

I was wrong about Google. As soon as I started using it in 1999, I saw that this combination of simplicity and power was the future of search, and that search was the key to the Web. But I didn’t see the enormous economic engine that search intent could generate. I didn’t want to work at Google while it was still a relatively small company.

So I’m probably wrong about Bitcoin. For reasons I’ll go into towards the end of this post, I feel it’s very important to state this at the beginning. If you already know I’m wrong, your time is much better spent reading and re-reading this wonderful piece by Marc Andreessen, the finest articulation of the potential power of Bitcoin yet written. (Incidentally, I’ve concluded that I was wrong when I said that Andreessen is probably the best living tech entrepreneur, but would be a mediocre VC. He’s already proven he’s a great VC.)

Again: please stop reading if you already know I’m wrong.

I don’t believe in Bitcoin, I don’t believe that it’s the foundation of a new age, a wave to follow the PC, the Internet, the Web. My resistance to the judgment of my betters is broad and deep, logical and emotional, based on fact and conjecture. So clearly, I’m not trying to win an argument here. I just want to someday look back on this and laugh. Or cry, as the case may be.

The roots of my skepticism about Bitcoin grow from three areas, which I’ll call What’s Missing, What I Know From Experience, and What’s Distasteful.

What’s Missing

As I humblebragged above, I knew about some of the key life-changing technologies of our time before most people. I may have been wrong about just how far they would go, but I was right to be curious about them, right to try them before they were popular, and right to enjoy their early incarnations. I had that curiosity and enjoyment from the minute I heard about them, and that enjoyment was sustained and nourished through each and every use.

I’m not curious about Bitcoin, at least, not curious enough to try it. As a consumer (not as a technologist, futurist, or business person), I don’t see why I might enjoy using it. I can understand why it has speculative value, but the joy of a good return from a speculative investment is nonspecific to Bitcoin. As a consumer, what’s in it for me?

The shortest description of the most obvious consumer proposition for Bitcoin is that it’s digital cash. But I’m not actually having a problem with the features of non-digital cash. Making digital payment behave exactly like cash would introduce giant problems into my life without solving any.

The first problem is the fear of seller fraud, i.e. how to address the problem that the person selling the goods might not actually deliver the goods. Bitcoin could, in theory, help quite a lot with buyer fraud, since once Bitcoins are transferred it’s just like receiving cash. But I’m mostly a consumer, not a seller, and as a consumer I don’t like to hand cash over to anyone unless I receive the goods at the same time or before I give the cash. Under what circumstance besides anonymity could I possibly want to use digital cash rather than a credit card? A credit card gives me the assurance that if I’m truly defrauded by the seller, I can always call the credit card company and demand a chargeback. Bitcoin advocates talk about chargebacks as a merchant’s curse (which it is), without addressing how the same thing is an honest consumer’s blessing.

Another big problem is the fear of loss and theft. I have this problem with real cash already, I don’t want to keep an excessive amount on my person or in my home or business. I don’t want to forget where I put it, I don’t want someone to steal it. Digital cash makes this an enormous problem, since I can now have a very large amount of cash, which becomes a very attractive target for theft, and a very sad potential case for loss. Sure, I can protect my digital cash with all manner of digital locks and keys, but this makes my cash security problems worse, not better. Banking has lots and lots of problems, but one of them is not that if I forget my key, I lose all my money.

I understand that these are problems of privilege, first world problems, and I’m not addressing the benefits that Bitcoin’s success would have for problems particular to the developing world. But I’m also not aware of any mass consumer technology that became successful due to features that benefitted developing economies without solving first world problems first. That may be sad, but it’s true.

What I Know From Experience

How many people have managed the growth of a new currency from its early days through its use in hundreds of millions of dollars worth of transactions per year? I don’t know, but I suspect that the number is only in the dozens, and I know that I’m one of them. So I cannot help but view the prospects for Bitcoin through the lens of what I learned from developing the Linden Dollar as a product for Second Life. This experience might provide some special insight, but it also almost certainly comes with bias, false equivalencies, the color of regret and the specter of envy. Nevertheless, I can’t talk about Bitcoin without thinking of the Linden Dollar.

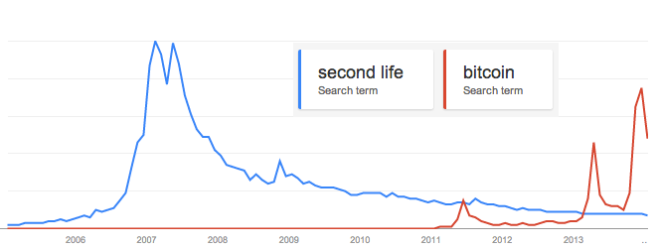

Since memories are short, let me try to explain the Linden Dollar very briefly. Second Life was once a thing that had the same level of interest as Bitcoin does today, actually a bit more judging by search queries:

The Linden Dollar is a virtual currency, the primary medium of exchange for transactions in the virtual world of Second Life. At its peak, people using Second Life used the Linden Dollar to buy and sell virtual goods worth more than half a billion dollars per year. Although there are many other digital worlds featuring the ability to get goods in exchange for some virtual token, the Linden Dollar had some unusual features that didn’t exist or weren’t allowed by similar services. The L$ could be transferred from user to user, and could be exchanged for a price in US dollars (and Euros and other currencies). Linden Lab, the company making Second Life, could issue new Linden Dollars in any amount and at any price, without any guarantee of redemption for any value, making the L$ a true fiat currency (i.e. having value by declaration rather than by guarantee of exchange for something of value, like gold).

It’s fair to say that the Linden Dollar was inferior to Bitcoin in every possible aspect of technical implementation, particularly the cryptological security measures. And it was not only centrally managed, but subject to the inflationary risks inherent to management of a money supply by an unstable government (i.e. a startup). Bitcoin advocates would have no problem listing dozens of feature inadequacies and design mistakes for the Linden Dollar. But I don’t think that the absence of any of Bitcoin’s vaunted features are the reason that the Linden Dollar didn’t reach mass success.

The Linden Dollar failed to reach a mass audience because Second Life failed to reach a mass audience. Even with SL’s shortcomings, the L$ might still have reached a broad audience if it had also become an accepted medium of exchange on another successful platform. The features and design of a currency can preclude certain types of failure (e.g. widespread fraud), but with one possible exception* they cannot be the driving reason for success. A currency, or any payment method, succeeds not because of its features, but because of the adoption of the platform on which the currency is the primary medium of exchange. As I have argued elsewhere, the value of the platform is the dominant factor in determining whether the medium of exchange for that platform will be successful. Consider the US dollar, which is after all Bitcoin’s true competition. The “platform” for the US dollar is the United States economy. The US$ has many feature deficiencies, and has undergone many design changes over the years. Someday the US dollar will fail to be the world’s dominant currency. That day will come after the United States is no longer the world’s largest economy, and not a day before.

Now, it’s arguable that the platform for Bitcoin is the Internet, and that economic transactions running through the Internet could exceed the US GDP (minus the portion running through the Internet). So perhaps we are on the cusp of seeing Bitcoin take the place of the US$, not because the features of the currency make it better than the US$, but because the US GDP is smaller than Internet GDP, and no rising country GDP (i.e. China) grows fast enough to fill the vacuum. But that’s not Bitcoin winning through superior features or technology, that’s the US economy failing and the world not wanting to rely on China’s economy.

What’s Distasteful

If it’s not clear enough already, this post is driven by personal taste, experience and bias as much as it is by fact and logic. So I may as well conclude with the least logical portion. I started this post by admitting that I’ve been wrong about pretty much every important technology trend in my lifetime, and practically begged many readers to read something else. Now I’ll admit that I don’t actually think I’m a moron. As I pointed out, I enjoyed and was excited about the PC, the Internet, the Web as soon as I saw them. I was right, I just didn’t make many important personal decisions based on that belief. (As an aside, I don’t actually regret the decisions I made instead. Life is full of wonderful choices.)

But I wanted to give Bitcoin fanatics every reason to dismiss this post without comment, because I’ve observed that Bitcoin skepticism is often attacked with an onslaught of vituperative insult. Now, this is true of the current sad state of Internet commentary generally, but here I’m excluding the routine trolls and bitter ignoramuses, and thinking of people who are clearly capable of intelligent, reasoned discussion. Some very smart and often nice people are Bitcoin fanatics, but in the eyes of many intelligent true believers on this topic, skeptics aren’t just wrong but idiotic, not just shortsighted but malicious. That reaction is of course is distasteful, but the point here isn’t just that I have delicate sensibilities. The point is pattern recognition: I have seen this kind of fanaticism many times, and it is usually a sign that merit of the proposition cannot speak for itself.

*The possible exception to all of my skepticism for Bitcoin is micropayments. I think this could be a compelling use case, though not in digital content payments because the problem with many digital content models is not that people don’t have a good means to pay, but that they would rather receive inferior free content than superior paid content at any price. But micropayments in antispam implementation or for microtransactions in data transmission generally is very interesting. This is the one area where I’ll continue to think about what Bitcoin could mean. After all, I’ve been wrong before.

Hi ginsudo,

Could you please get in touch with me?

LikeLike

Quoting you…”So perhaps we are on the cusp of seeing Bitcoin take the place of the US$, not because the features of the currency make it better than the US$, but because the US GDP is smaller than Internet GDP, and no rising country GDP (i.e. China) grows fast enough to fill the vacuum.”…

This is an interesting thought.

The C64 was cool.

There is an interesting conflict with: …”I have been wrong with techs…” and the depth of the post and the declaration of experience supporting your thoughts. Interesting, I see a similarity in the cultural contrast generated by two cultures merging in you, creating a powerful twist.

Bitcoin, yes, something I have also been observing with interest, like most of us. Too fucking complicated. I even thought of farming… at a certain point of my exploration on the subject. Too much hassle, too complicated for mainstream. Maybe in future? Maybe… As you said Ginsu, before Bitcoin can be what the US$ is, it will take the fall of the entire economic system, not only the US one. Possibly in a future where Governments will be replaced by communities, then maybe…

Cheers.

mc

LikeLike

Some unstructured thoughts here. DISCLAIMER: I own 1 bitcoin which I idiotically bought for nearly $1000. I’ve never spent Bitcoin to buy goods on services so my actions have only been commodity speculation and not transactional utility. It’s interesting is that Bitcoin as a “currency” falls somewhere between commodity value and transactional ease/trust/utility. So what’s the point?

I’m guessing that all arguments, pro and con are theoretical until a couple years out, by which time 2 things will have become clear. 1. the idea that Bitcoins are finite 2. It’s easy to use them without remembering kooky passwords and/or freaking out before you hit the buy button and 3. there’s a reason to use them that’s better than anonymity.

For now, using the Tor browser and poking around Silkroad 3 was the first moment I got it. (Of course I’m too respectable to buy heroin from Holland) but it was easy to play the whole thing out. In case you haven’t bought smack or ordered a hit recently, here’s what I think it looks like:

Shop around using the least sketchy marketplace. Create the least obvious password, username etc.

Find what you want. Only buy from seller w/ most positive reviews. (that’s the most important argument for bitcoin IMHO. For transfer of Physical items, some other reputation system is still required but the purchase is anon and shipping goes somewhere you chose smartly).

For microtransactions for digital goods, I’m still baffled. Just can’t imagine stuff worth pennies that also needs a hassle factor.

The rest of the zeitgeist that says “the Blockchain’s where it’s at” seems plausible – Andreesen’s argument that contracts, payments, etc.can occur WITHOUT trust feels naive ie. even though a non-trusted and universally verifiable contract occurred it will always be more costly to work out who screwed who than to just get on with it.

LikeLike